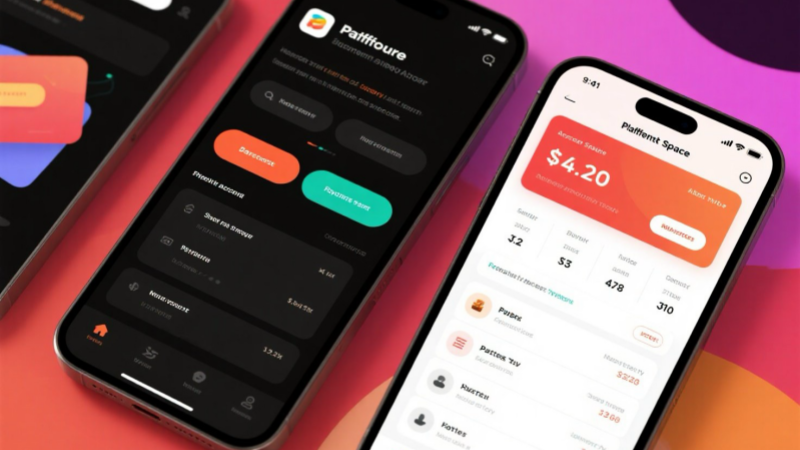

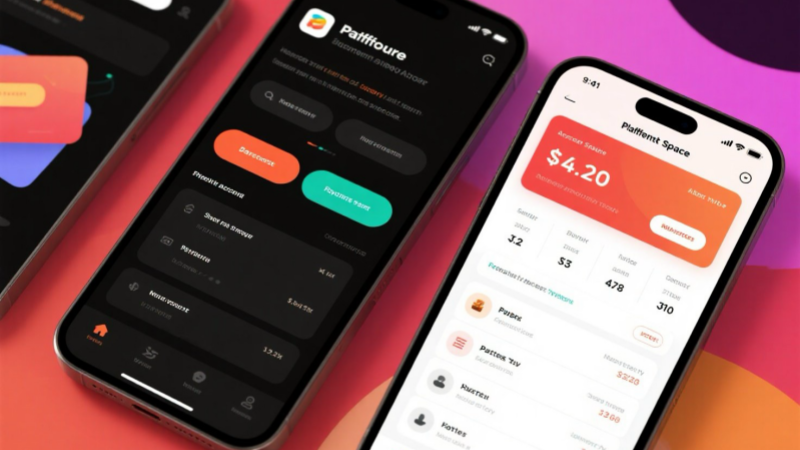

In the mobile payment space, Cash App has become a popular tool for users worldwide thanks to its simple transfer functionality and diverse financial services. The resulting “Cash App Clone” ecosystem is penetrating the market with even more flexibility. From basic “Cash App Clone apps” to various “Cash App Clone APK” installation packages, these clones retain the core strengths of the original while demonstrating unique value in localized services. This article will provide an in-depth analysis of Cash App Clone’s features, download security, and collaboration with Parallel Space, providing users with a comprehensive reference.

Cash App Clone’s Core Functions and Advantages

Definition and commonalities: cash app clone’s diverse forms and core architecture

Cash App Clone is not a single product, but rather a broad term for all mobile payment tools that mimic Cash App’s core architecture. These apps typically retain three core features: instant transfers, digital wallet management, and convenient payments, while also adding differentiated features tailored to the needs of their target market.

Core competitiveness: implementation of full-scenario payment capabilities

Fully implementing payment capabilities is Cash App Clone’s core competitive advantage:

- By linking a bank or credit card, users can make instant point-to-point transfers, with fingerprint or facial recognition support for fund security.

- In commercial scenarios, merchants simply generate a unique payment code, which consumers can scan with the Cash App clone app to complete payment. This fee-free feature has made it popular among small and medium-sized businesses.

- Some clones also support cross-border transfers. By integrating multiple payment channels, they can reduce the processing time of traditional banks, which typically takes 3-5 days, to within 24 hours. The exchange rate is also more competitive than that of offline remittances.

Refined management: scenario adaptation of the hierarchical wallet system

A hierarchical wallet management system meets users’ refined needs.

- The basic wallet is used for daily small payments, supports automatic balance management, and integrates with money market funds for increased returns.

- Dedicated wallets allow users to set spending limits and use tags, such as “travel fund” and “education reserve,” to help users manage their budgets.

- Compared to the original Cash App, some Cash App clones also include a bill splitting feature. After a get-together or team event, the initiator can generate detailed expense information and initiate a payment with a single click, eliminating the tedious manual calculations.

Function extension: expansion of scenarios for additional financial services

Additional financial services expand the app’s use cases.

- Many cloned apps integrate essential services like mobile top-ups and utility bill payments, allowing users to pay various bills without switching apps.

- More advanced versions even include cryptocurrency trading modules, supporting the purchase and redemption of mainstream currencies like Bitcoin and Ethereum. Their interface is simpler than that of specialized trading platforms, making them suitable for beginners.

Download Channels and Security Risk Analysis

There are two main ways to obtain Cash App clones: official channels and third-party platforms, each with significant differences in security and convenience.

Official channels are the most reliable option. Legitimate “cash app clone apps” are listed on major app stores (such as the Apple App Store and Huawei AppGallery), and users can download them by searching for their names.

APK files from third-party platforms pose a higher risk. Due to regional restrictions on app stores, users in some regions may choose to download “cash app clone apk” or “cash app cloner download” installation packages from forums or websites. These files may be tampered with and contain malicious programs that steal payment information. A 2024 security agency survey revealed that 37% of financial clone apps downloaded from unofficial channels posed a data breach risk. Users are advised to scan APK files with online tools such as VirusTotal before installing and to disable the “install apps from unknown sources” permission.

Be especially wary of free scams. Users should carefully read the terms of service within the app and prioritize products with clearly stated pricing and no ad interruptions.

Synchronous Use Cases with Parallel Space

Parallel Space, a multi-app application development tool, can effectively collaborate with Cash App Clone to solve the pain points of managing multiple accounts. Its core value lies in application isolation through sandboxing technology, allowing multiple payment accounts to run simultaneously on the same device without interfering with each other’s data.

Separating personal and business accounts is the most common use case.

Small business owners or freelancers can use Parallel Space to simultaneously log in to both the personal and business versions of their “Cash App Clone app,” using the former for daily purchases and the latter for collecting and paying suppliers.

Cross-border payment account management is now more convenient.

Users with two payment accounts, both domestic and international, can run Cash App Clone apps for each region in Parallel Space, eliminating the need to repeatedly switch between accounts. For example, using the US version of the clone app to receive US dollar payments from overseas customers while simultaneously withdrawing RMB through the domestic version. Exchange rate conversion and fund arrival progress can be monitored in real time on both screens, significantly improving operational efficiency.

Redundant security design enhances fund protection.

By isolating your primary and backup accounts through Parallel Space, you can use the backup account to make emergency payments even if your primary account is temporarily frozen due to unusual activity. Some users also run a “cash app clone APK” in Parallel Space as a testing environment to verify the security of new features or unfamiliar transfers before operating from their primary account to mitigate financial risk.

Note that not all Cash App clones support multiple accounts in Parallel Space. Some apps detect multiple accounts and restrict functionality to prevent money laundering and other illegal activities. Users are advised to test the usability of core functions (such as transfers and payments) before officially using them to avoid impacting normal use.

Market Selection and Usage Recommendations

Selection criteria: Three core indicators to lock in suitable products

With so many Cash App clone products available, users should make a rational choice based on their specific needs. Prioritize three core metrics: first, payment channel stability.

- Review app reviews to understand transfer success rates and processing speeds.

- Second, security certification. Choose products certified to the PCI DSS payment security standard to ensure encrypted card information storage.

- Third, localized services. For example, in Southeast Asian markets, clone apps that support local wallets like GrabPay and DOKU are more convenient.

Scenario-based selection: adaptation suggestions from personal to business

- For individual users who only need basic transfer functionality, lightweight “cash app clones” are sufficient. These apps take up little storage space (typically under 50MB) and launch quickly.

- Business users should opt for advanced versions that support batch transfers and automatic reconciliation. Some products also offer APIs for integration with store checkout systems to automatically synchronize transaction data.

Safety Guide: Practical Tips for Risk Avoidance

Pay attention to account security during use:

- Avoid using public WiFi for large transfers, enable two-step verification,

- Regularly check transaction records, and freeze your account if any anomalies are detected.

- Never share your payment password or verification code with others.

- When using Parallel Space, regularly clear the application cache to prevent redundant data from impacting performance.

Summary

Cash App Clone offers users diverse mobile payment options through flexible feature design and localized adaptation. From securely accessing cash app clone download free resources to obtaining the “Cash App Clone APK” and managing multiple accounts with Parallel Space, effective use of these tools can significantly improve payment efficiency. However, it’s important to remember that the core value of financial tools lies in serving our lives. Choosing legitimate products and adopting standardized operating practices can ensure both convenience and financial security. As payment technology continues to evolve, these clone apps may incorporate more AI-powered risk management and scenario-based services, further reshaping the boundaries of mobile financial experience.

FAQ

1. What opportunities does the Cash App Clone ecosystem offer for users and developers?

For users, Cash App Clones provide localized payment solutions (e.g., regional wallet integrations) and cost-effective alternatives with reduced fees. For developers, they offer opportunities to innovate in underserved markets (e.g., emerging economies) by adapting features like simplified UI or local payment channel support.

2. How to safely choose and use a Cash App Clone?

Prioritize clones with PCI DSS security certification and positive user reviews (to verify payment stability). Download from official app stores instead of untrusted “cash app clone apk” sources. Enable two-factor authentication and avoid public WiFi for transactions to protect account security.

3. What practical scenarios make Cash App Clones more useful than the original?

Clones often excel in localized use cases: supporting regional payment methods (e.g., GrabPay in Southeast Asia), offering lower cross-border transfer fees, or integrating niche features like local utility bill payments—making them more tailored to specific market needs than the original Cash App.

In the mobile payment space, Cash App has become a popular tool for users worldwide thanks to its simple transfer functionality and diverse financial services. The resulting “Cash App Clone” ecosystem is penetrating the market with even more flexibility. From basic “Cash App Clone apps” to various “Cash App Clone APK” installation packages, these clones retain the core strengths of the original while demonstrating unique value in localized services. This article will provide an in-depth analysis of Cash App Clone’s features, download security, and collaboration with Parallel Space, providing users with a comprehensive reference.

In the mobile payment space, Cash App has become a popular tool for users worldwide thanks to its simple transfer functionality and diverse financial services. The resulting “Cash App Clone” ecosystem is penetrating the market with even more flexibility. From basic “Cash App Clone apps” to various “Cash App Clone APK” installation packages, these clones retain the core strengths of the original while demonstrating unique value in localized services. This article will provide an in-depth analysis of Cash App Clone’s features, download security, and collaboration with Parallel Space, providing users with a comprehensive reference.